Credit 101

THINGS THAT CAN BE REMOVED:

Collections Accounts

When an account becomes seriously past due, the creditor may decide to turn the account over to an internal collection department or to sell the debt to a collection agency. Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your credit report. Collection accounts have a significant negative impact on your credit scores.

Repossessions

Repossession hurts your credit score. In fact, it’s one of the worst things that can happen to your credit, making your financial life more difficult for years to come. First, the late payments leading up to the repossession will damage your credit score once they’re reported to the credit bureaus. Then, the repossession itself will be listed on the public records section of your credit report.

Charge Offs

A charge-off is a debt that a creditor has given up trying to collect on after you’ve missed payments for several months.

These can include balances from a credit card, mortgage or other debt you take on. As a last resort, the creditor can decide that the debt is a loss for the company and designate it as “charged off.”

Delinquencies or Late Payments

Payments that are less than 30 days late often do not show up on someone’s credit report, unless they occur frequently. When they do show up, they can remain on that person’s credit report for up to seven years, after which they fall off automatically.

Hard Inquiries

Hard inquiries can be harmful to a borrower’s credit score. Each hard inquiry usually causes a small decrease in their credit score. Hard inquiries remain on one’s credit report for up to two years. Generally, a high number of hard credit inquiries in a short period of time can be interpreted as an attempt to substantially expand available credit which means higher risk for the lender.

Foreclosures, Short Sales, Bankruptcies, Tax Liens, Judgments, & Much More!

What is a Credit Score?

A credit score is a number generated by a mathematical formula that is meant to predict creditworthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and manage to get approved for credit, your interest rate will be much higher than someone who had a good credit score. So, having a high credit score will save you many thousands of dollars.

What Is A Credit Bureau?

A credit bureau is a company that collects and maintains your credit information and sells it to lenders, creditors and consumers in the form of a credit report. There are dozens of credit bureaus, we’re most concerned with the big three: Equifax, Experian, and TransUnion.

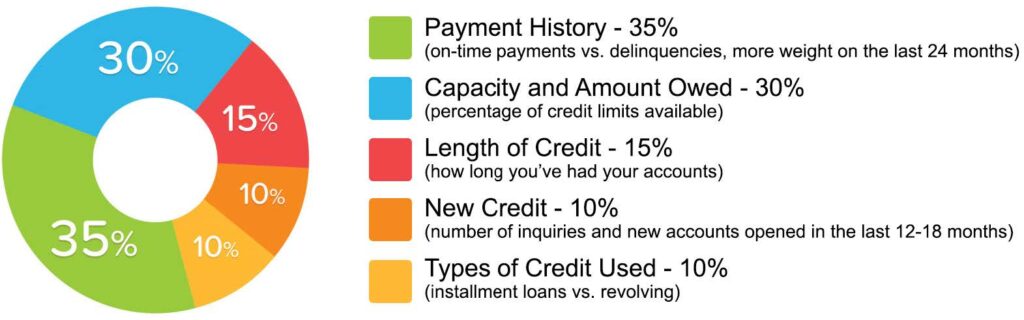

How Credit Bureaus Determine your Credit Score

The percentages in this chart show how important each of the categories is in determining your credit score. We will help you to remove negative items from your payment history. We will also show you how to maximize your debt ratio score, even if paying off credit cards is not an option.

How Your Behavior Is Evaluated In Your Credit Report:

Do you pay your bills on time? Payment history is a major factor in credit scoring. If you have paid bills late, have collections or a bankruptcy, these events won’t reflect well in your credit score.

Do you have a long credit history? Generally speaking, the longer your history of holding accounts is, the more trusted you will be as a borrower.

Have you applied for credit recently? If you have many recent inquiries this can be construed as being negative by the bureaus. Only apply for credit when you really want it.

What is your outstanding debt? It is important to not use all of your available credit. If all of your credit cards are maxed out, your scores will reflect that you are not managing your debt wisely.

Credit Score Meaning

800 and Higher (Excellent) With a credit score in this range no lender will ever disapprove your loan application. Additionally, the APR (Annual Percentage Rate) on your credit cards will be the lowest possible. You’ll be treated as royalty. Achieving this excellent credit rating not only requires financial knowledge and discipline, but also a good credit history. Generally speaking, to achieve this excellent rating you must also use a substantial amount of credit on an ongoing monthly basis and always repay it ahead of time.

700 – 799 (Very Good) 27% of the United States population belongs to this credit score range. With this credit score range, you will enjoy good rates and approved for nearly any type of credit loan or personal loan, whether unsecured or secured.

680 – 699 (Good) This range is the average credit score. In this range approvals are practically guaranteed but the interest rates might be marginally higher. If you’re thinking about a long term loan such as a mortgage, try working to increase your credit score higher than 720 and you will be rewarded for your efforts; your long term savings will be noticeable.

620 – 679 (OK or Fair) Depending on what kind of loan or credit you are applying for and your credit history, you might find that the rates you are quoted aren’t best. That doesn’t mean that you won’t be approved but, certain restrictions will apply to the loan’s terms.

580 – 619 (Poor) With a poor credit rating you can still get an unsecured personal loan and even a mortgage, but the terms and interest rates won’t be very appealing. You’ll be required to pay more over a longer period of time because of the high interest rates.

500 – 579 (Bad) With a score in this range you can get a loan but nothing even close to what you expect it to be. Some people with bad credit apply for loans to consolidate debt in search for a fresh start. However, if you decide to do that proceed cautiously. With a 500 credit score you need to make sure that you don’t default on payments or you’ll be making your situation worse and might head towards bankruptcy, which is not what you want.

499 and Lower (Very Bad) If this is your score range you need serious assistance with how you handle your credit. You’re making too many credit blunders and they will only get worse if you don’t take positive action. If you are thinking of a loan (which won’t be easy), the rates will be very high and the terms will be very strict. We recommend that you fix your credit first before applying for a loan.

After starting the credit dispute process with you, what can you do to help raise your credit score?

Check out our helpful tips links page.

Pay all of your bills on time, every time. This includes your utility bills, mortgage, and auto payments, and all of your revolving lines of credit like credit cards. Check your credit report at least once a year. You can find out how to challenge bad information on your credit report here.

Never charge more than 30% of the available balance on any of your credit cards. Banks like to see a nice record of on-time payments, and several credit cards that are not maxed-out. If you are carrying high balances on your credit cards, then make paying them down below 30% a priority.

Do use your credit cards – Many people who make mistakes with their credit believe that the best way to fix things is to never use credit again. If you are afraid that you cannot handle your credit cards correctly then the best policy is probably this one: Run only your utility bills on your credit cards each month and then pay the balance in full by the due date. This ensures that your utility bills get paid on time automatically, and as long as you keep the habit of paying off your credit card balance each month your score will continue to go up. Leave the credit cards locked in a safe or drawer at home. Keep your accounts open as long as possible – Even if you are no longer charging on the card. The best policy is to keep those unused accounts open, & blow the dust off your card every few months to make a small purchase, then pay it off. How long each of your accounts has been active is a major factor in your credit score.

Remember that this all takes time – Following the above steps consistently over a long period of time will increase your credit score and allow you to qualify for better loans and lower interest rates. Repairing your credit score does not happen overnight, so if you do these things for a few months and do not see a large increase in your score, do not give up. They are all habits that you will want to maintain throughout your life, as they will help you to keep your finances and lines of credit under control.

How long will certain items remain on my credit file?

- Delinquencies (30- 180 days): A delinquency may remain on file for seven years; from the date of the initial missed payment.

- Collection Accounts: May remain seven years from the date of the initial missed payment that led to the collection (the original delinquency date). When a collection account is paid in full, it will be marked as a “paid collection” on the credit report.

- Charge-off Accounts: When a delinquent account is sent to a collections company. This will remain for seven years from the date of the initial missed payment that led to the charge-off (the original delinquency date), even if payments are later made on the charge-off account.

- Closed Accounts: Closed accounts are no longer available for further use and may or may not have a zero balance. Closed accounts with delinquencies remain for seven years from the date they are reported closed, whether closed by the creditor or by the consumer. However, the delinquency notation will be removed seven years after the delinquency occurred when pertaining to late payments. Positive closed accounts continue to be reported for ten years from the closing date.

- Lost Credit Card: If there are no delinquencies, credit cards reported as lost will continue to be listed for two years from the date the creditor is contacted. Delinquent payments that occurred before the card was lost are reported for seven years.

- Bankruptcy: Chapters 7, 11, and 12 will remain on one’s credit report for ten years from the filing date. A Chapter 13 bankruptcy is reported for seven years from the filing date. Accounts included in a bankruptcy will remain for seven years from the date reported as included in the bankruptcy

- Judgments: Remain seven years from the date filed.

- City, County, State, and Federal Tax Liens: Unpaid tax liens remain for fifteen years from the filing date. A paid tax lien will remain on one’s score for 10 years from the date of payment.

- Inquiries: Most inquiries listed on one’s credit report will remain for two years. All inquiries must remain for a minimum of one year from the date the inquiry was made. Some inquiries, such as employment or pre-approved offers of credit, will show only on a personal credit report pulled by you.

Information that cannot & should not be on a credit report:

- Medical information (unless you provide consent)

- Notice of bankruptcy (Chapter 11) more than ten years old

- Debts (including delinquent child support payments) more than seven years old

- Age, marital status, or race (if requested from a current or prospective employer)

- We will show you how to maximize your debt ratio score, even if paying off credit cards is not an option.

- We can also help you to remove credit inquiries from your credit report. Most people are aware of the three credit reporting bureaus, Equifax, Experian, and TransUnion. The average difference in scores between the highest and lowest of your credit scores, from the three bureaus, is 60 points. This is the result of the credit bureaus having different items on their report, which may be correct, incorrect or are not reported in full compliance with credit law. According to a recent study, nearly 80% of all credit reports have serious errors on them and this does not even include the even smaller errors for which we look.

Please be aware that by using the FCRA and Melissa’s knowledge of consumer credit law Pure Freedom Inc will work with you to help you eliminate incorrect/negative and damaging/derogatory information from your credit reports.

All the work is done for you or help and guide you from start to finish if you chose to do it on your own.

Our fees are reasonable and there are NO long binding contracts. We guarantee results within 90 days or your money back!

*In order to qualify for a money-back guarantee, If it has been longer than 6 months, but less than 2 years that you or another company has worked on your credit. You don’t qualify for the money-back guarantee.